미디어 시장 변화…한계 봉착 케이블과 희망 생긴 OTT | 연합뉴스(The media market is changing...Cable's limits and OTT's hopes are rising | Yonhap News Agency)

Yonhap News Agency published an article analyzing changes in the Korean and U.S. media markets. This article discusses the significant changes in the media market, highlighting the struggles faced by cable TV, which is experiencing stagnation and financial losses

Yonhap News Agency(By Jung-hyun, Lee) published an article analyzing changes in the Korean and U.S. media markets.

This article discusses the significant changes in the media market, highlighting the struggles faced by TV network and cable TV, which is experiencing stagnation and financial losses, against the backdrop of the rising success of OTT (Over-The-Top) platforms.

The main theme revolves around the transition from cable tv to streaming services, outlining how OTTs, such as Tving and Coupang Play, are gaining ground due to their innovative offerings and growing subscriber base.

미디어 시장 변화…한계 봉착 케이블과 희망 생긴 OTT | 연합뉴스 (yna.co.kr)

Takeaway

Cable TV industry in South Korea is facing financial decline and stagnation.

- Q2 revenue of KT Skylife dropped to 254.6 billion KRW with an operating loss of 1.59 billion KRW.

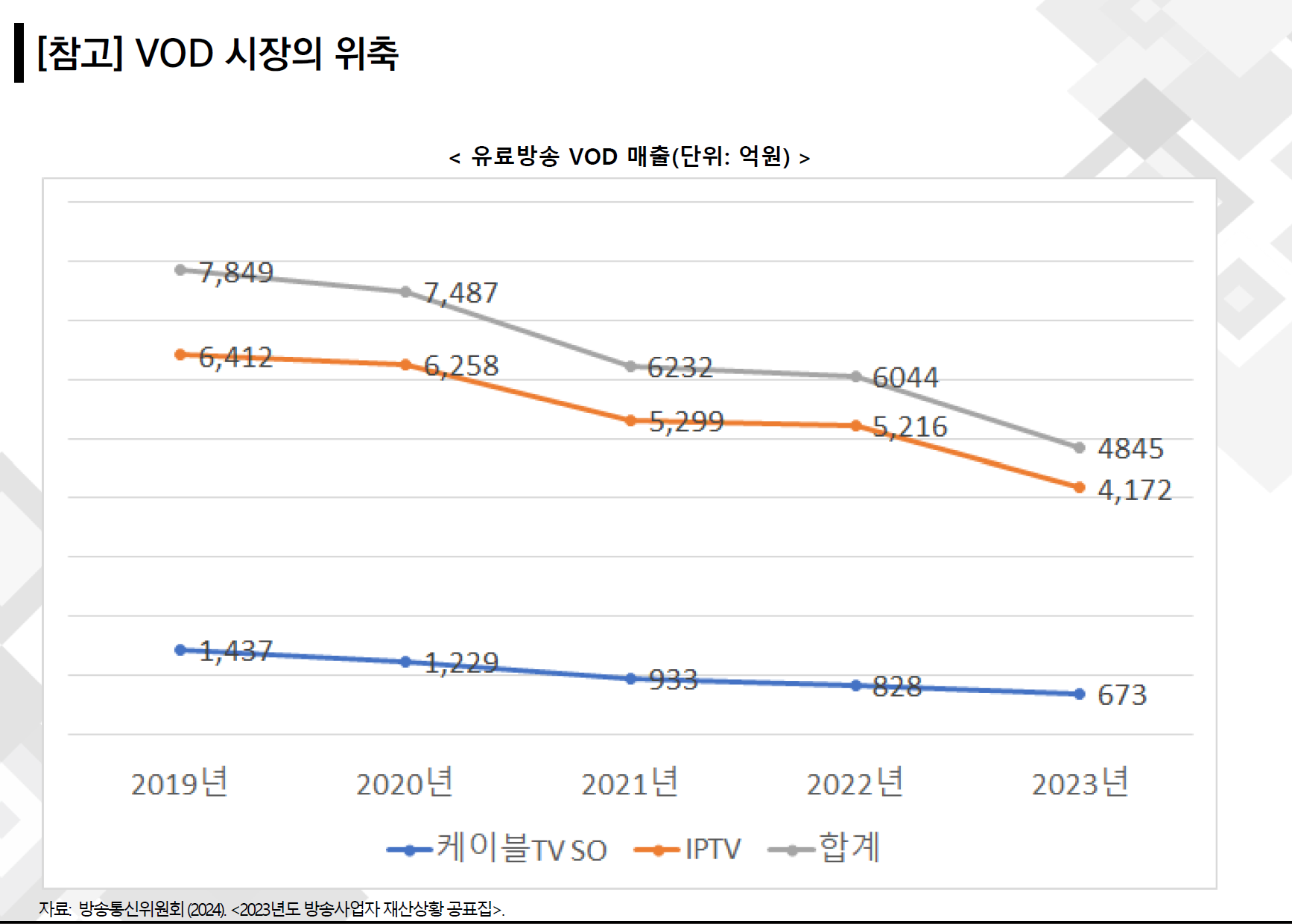

- LG HelloVision and HCN(major cable TV) will stop providing freeVOD(provided by major TV networks) starting from next month.

- Operating profit margin for cable TV declined from 12.6% in 2018 to 1.2% in 2022.

- The Korea Cable TV Association(KCTA) has yet to devise effective solutions despite forming an emergency management committee

Korea's local OTTs are increasingly influential and growing in the South Korean market.

- Wavve viewership surged by approximately 2.3 times during the Paris Olympics due to athletes' performances.

- The Korean subscription-based VOD market increased by 705,000 subscribers in the first half of the year, reaching 20.8 million users.

- The market size of Korean subscription VODs grew by 11% compared to the previous year, reaching $922 million.

- Total viewing time of OTT content increased by 5% to 103 billion minutes.

The media market is experiencing a shift from cable TV to OTT services.

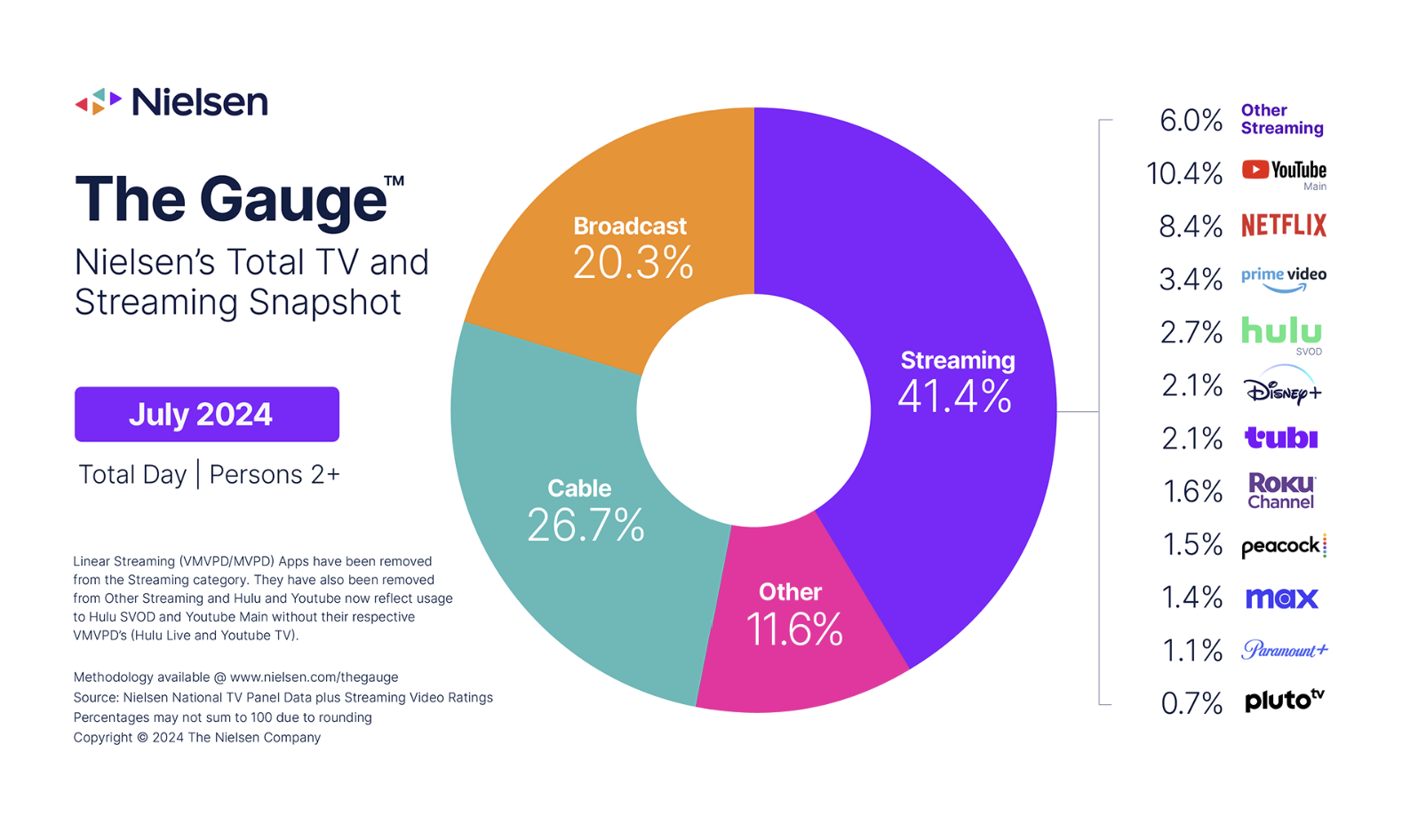

- DirectMediaLab, news media which specialize in entertainment technoloy predicts that the decline in cable TV and the rise of OTT will intensify.

- Sports streaming rights for major events like MLB, NBA, and NFL are increasingly secured by OTT platforms.

- Affordable ad-based plans are attracting customers despite the rapid increase in streaming subscription fees.

- Legacy media must innovate with hybrid models like FAST and regional home shopping channels to survive.

This is full sentence (Seoul, South Korea) By Jung-hyun, Lee

The contrast between the Korean cable TV industry and the OTT industry is becoming clearer.

Korea Cable TV industry is in a state of virtual regression, with no growth and no major stagnation.

According to industry reports on Thursday, KT Skylife's second-quarter results showed a consolidated revenue of KRW254.6 billion and an operating loss of KRW159 million. The loss was down from a profit of 16.8 billion won in the same quarter a year earlier.

In the face of the downturn, the cable TV industry has begun to discontinue free video-on-demand (VOD) services that have been offered for free. LG HelloVision and HCN will end their free VOD services from the 3rd of next month. KCTV Kwang-Ju,gcs corp, JCN and CCS Chungbuk TV will also be shutting down.

At a recent seminar of the Korea Broadcasting Association's 'Establishing Standards for Reasonable Pay-Broadcasting Content Consideration', Hoseo University Professor Kwak Jeong-ho identified major pay-TV operators as 'marginal operators' and said, "The deterioration of pay-TV management means that the financial resources available to pay for content will eventually decrease, so we are concerned about the simultaneous collapse of the pay-TV market and the content market."

According to the 2023 Broadcasting Market Competition Situation Assessment Report, the operating profit margin of the cable TV (MSO) broadcasting sector plummeted from 12.6% (KRW 233.4 billion) in 2018 to 1.2% (KRW 19.3 billion) in 2022.

The cable TV industry has created an emergency management task force centered on the Korea Cable TV Broadcasting Association to come up with a survival plan, but it hasn't come up with any concrete measures.

OTT, on the other hand, is becoming increasingly influential through propaganda such as TVing, Coupang Play, and Wavve.

At the recent Paris Olympics, Wave's viewership surged 2.3 times more than usual as athletes continued to win medals. Tving has also recently seen an increase in the number of users due to the popularity of its original content.

The Korean subscription VOD market grew by 750,000 subscribers in the first half of this year to reach a total of 28 million, according to a new report by research and consulting firm AMPD and Media Partners Asia.

South Korea's subscription video-on-demand (OTT) market grew 11% year-on-year to $922 million in the first half of this year, driven by subscriber growth, according to a new report from research and consulting firm AMPD and Media Partners Asia. Viewing hours grew 5% to 130 billion minutes.

Media research firm DirectMediaLab observed that the ongoing trend of 'cable TV weakness, OTT strength' in the media market is likely to intensify.

In particular, the difficulties of pay-TV are bound to be exacerbated by the shift of sports distribution to streaming, such as the streaming of professional baseball games, the Paris Olympics, the NBA, and the NFL.

"Rapidly rising subscription fees for streaming services may put pressure on share expansion, but the long-term outlook is not favorable for Pay-TV, as OTT providers are luring customers with a series of cheap ad-based plans," DirectMediaLab(www.directmedialab.com) said.

They suggested that legacy media, such as cable TV, should look for new revenue streams, such as offering "hybrid bundles" that include free ad-supported streaming service FAST, or strengthening media commerce, such as local home shopping TV.

뉴스레터를 구독하세요.

지금 뉴스레터를 구독하세요.

![[프리미엄 리포트] 미국 케이블TV 2025, 변화와 미래 전략](https://storage.googleapis.com/cdn.media.bluedot.so/bluedot.directmedialab/2025/05/vj931j_202505270106.png)